Recent discussions on naval shipbuilding have highlighted the importance of a vibrant and innovative defence industry for both strategic and economic security reasons. Prior experience with building the Anzac- frigates shows that Australia can build defence product to high quality and at globally competitive prices provided there’s a sufficient number of items, and a stable design, to develop efficiencies over the build program.

The government’s consideration of a continuous build of naval ships is positive. A much more concerning problem exists beyond the large, but narrow, confines of shipbuilding and as borne out in an analysis of contracts placed by the Defence Materiel Organisation (DMO). This problem centres on the trends within Australian defence industry and where it’s heading.

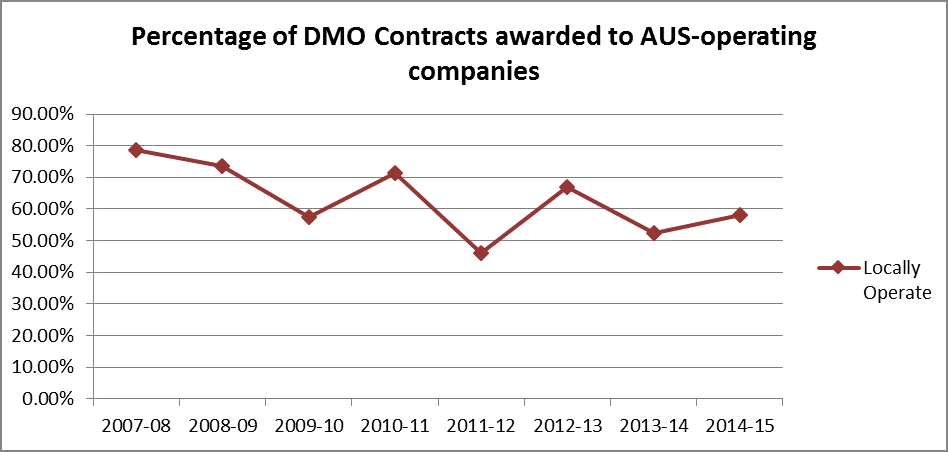

In the period from 1 July 2007 to 31 March 2015 the DMO has placed approximately 117,000 contracts worth a little over A$71 billion for acquisition, sustainment and sundry other items. In the financial year 2007–08 almost 80% of the DMO contracting was to companies operating within Australia, but this has steadily declined since that time to the current state where less than 60% are awarded locally. The movement of contracting activity is shown in the following graph. (All data from Austender.)

When only Australian-owned companies are considered the picture is far worse, and is significantly impacted by the amount contracted to ASC. When ASC is taken out of the equation less than 5% (by value) of all DMO acquisition and sustainment contracts are awarded directly to Australian-owned companies. This is less than half the amount awarded to Australian-owned companies in 2010 and earlier years.

When only Australian-owned companies are considered the picture is far worse, and is significantly impacted by the amount contracted to ASC. When ASC is taken out of the equation less than 5% (by value) of all DMO acquisition and sustainment contracts are awarded directly to Australian-owned companies. This is less than half the amount awarded to Australian-owned companies in 2010 and earlier years.

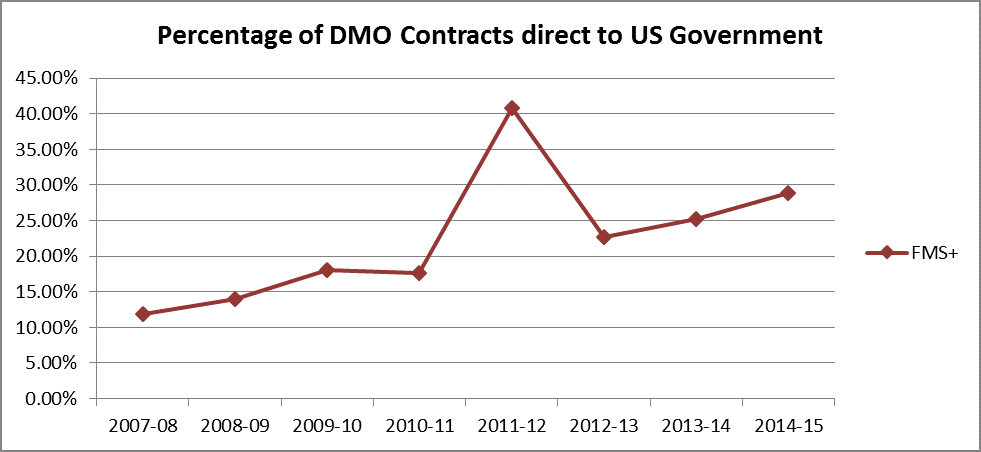

With respect to DMO contract award, the overwhelming winner is the US Government. In the period 1 July 2007 to 31 March 2015 the amount of DMO contracts (by value) placed directly with the US Government has increased by over 250%. Whilst there are some items of military hardware that can only be acquired through Foreign Military Sales (FMS) there’s no clear reason why repeated FMS orders are needed for the sustainment of items that have been in the Australian inventory for many years.

The current trend with respect to FMS contracting is shown in the following graph, and one can’t escape the conclusion that FMS is becoming the ‘route of convenience’, or maybe the path of least resistance, for defence contracting. (All data from Austender.)

But why does this matter? Isn’t it better for the Australian Defence Force (ADF) to have the best capability irrespective of where it comes from? There’s a certain merit in this position, but it’s also a strategic imperative that Australia be in a position to repair, maintain and upgrade the systems it has. Analysis of the DMO contract data shows that acquisition of equipment via FMS typically comes with significant support attached. This initial support may appear to be an attractive short term solution but to the detriment of developing local support capabilities for the new systems; repeated contracts are therefore placed into the US.

But why does this matter? Isn’t it better for the Australian Defence Force (ADF) to have the best capability irrespective of where it comes from? There’s a certain merit in this position, but it’s also a strategic imperative that Australia be in a position to repair, maintain and upgrade the systems it has. Analysis of the DMO contract data shows that acquisition of equipment via FMS typically comes with significant support attached. This initial support may appear to be an attractive short term solution but to the detriment of developing local support capabilities for the new systems; repeated contracts are therefore placed into the US.

Such contracting behaviour does nothing to build local capability to provide the support that might one day be required in extremis. Should that day come we’ll be beholden to an offshore entity to provide the support we require when we require it. The sovereign risk issues are obvious, yet currently seem to be swept under the carpet for expediency.

Unless we stop talking about industry as a fundamental input to capability and do something about its trajectory, the future of the Australian defence industry doesn’t look good. We need to determine those parts of industry that are associated with high strategic risk and then unashamedly support and develop them. We also need to determine how the defence industry sector plays into the wider industrial and economic base, and to make a policy decision that we’ll support defence industry activities that contribute to the national economic well-being. Those aren’t offsets in disguise. It’s not protectionism. It’s Australia as a sovereign nation taking actions that are associated with our national security.

There’s no doubt that Defence needs high quality capabilities. There’s also no doubt that the level of understanding within Defence of how a vibrant defence industry forms part of that capability is woefully lacking. It’s time that we faced the reality and did something about fixing the local defence industry problem while we can. The upcoming Defence White Paper provides an early opportunity to do this. Hopefully it will.