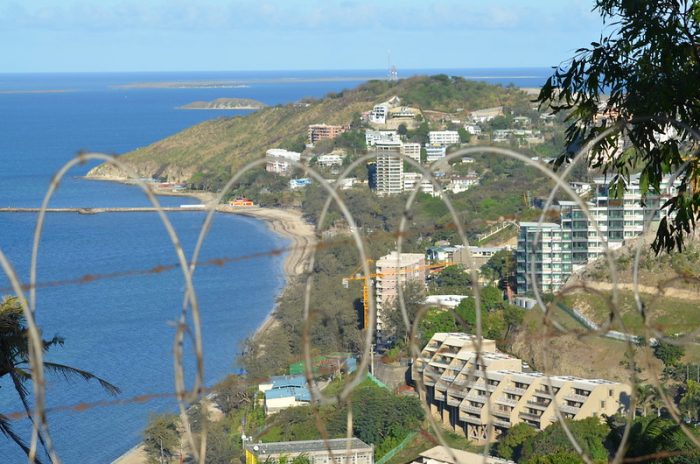

PNG already faces an economic, fiscal and social crisis—and coronavirus is still to come

Papua New Guinea faces its most critical economic, fiscal and social crisis since independence in 1975. This dangerous mix is largely unrelated to the coronavirus sweeping the world, despite attempts by some PNG leaders to claim otherwise.

PNG so far has just one confirmed case of Covid-19. But when the virus takes hold there, as it surely will, it will have a massive and tragic impact on the nation’s 10 million people.

The health system in PNG is wholly incapable of addressing a major upsurge in any illness or disease, let alone Covid-19. It has already started affecting tourism, travel and the nation’s airlines, but so far the impact remains comparatively minor. That will change quickly as the virus escalates.

It’s disappointing that leaders who have generally been upfront about the extent of the nation’s economic problems are now trying to shift the responsibility away from poor policies and unsatisfactory fiscal management that long predate the virus outbreak.

The real danger in this approach, which won’t fool thinking people in PNG, is that the virus may be used as an excuse for the tough decisions that their leaders can no longer avoid addressing. The people will doubtless be told the nation will recover from the impact of the virus, but those in charge may ignore or downplay the economic and fiscal challenges and their likely consequences.

The level of government debt is approaching 40% of GDP. The 2020 budget is clearly in serious difficulty, even after a substantial projected deficit is funded (if it can be funded). The economy is in decline and the government can’t evade its share of the responsibility for that.

Investment and confidence in the mining and oil and gas sectors have never been worse. The Papua LNG Project is effectively on hold. The Wafi Mine is in a similar position, and even the Ramu Nickel Mine expansion is off. The collapse in resource-sector-related construction is not only affecting employment and business, but also putting real pressure on foreign reserves and government revenue.

The government is understood to be in detailed negotiations with the International Monetary Fund and the Asian Development Bank on a budget support and debt management program reportedly worth around A$2 billion.

That will mean accepting tough IMF and ADB conditions.

These are certain to include a devaluation of the PNG kina, which has been propped up by the central bank. Any devaluation will boost exporters in the mining, oil and gas, and agricultural sectors. But it will force up the cost of imports that PNG remains too dependent on, such as rice and fresh milk, as well as consumer appliances and vehicles.

The IMF and ADB will undoubtedly demand massive cuts in public spending, especially recurrent spending on salaries and wages and related bureaucratic costs.

That will all be very tough medicine for Prime Minister James Marape and his government to have to swallow just two years out from the next national elections.

The real danger is that the government will try to bail itself out by another route—a massive debt management loan from the People’s Republic of China. The impact of the coronavirus on China’s economy might mitigate against that, but it’s still not off the agenda.

Soon after his election, Marape was in discussions with the Chinese embassy in Port Moresby about a total debt restructuring funded by China.

Last November, Australia’s urgent loan of $440 million helped finance the 2020 budget. It replaced a similar loan being negotiated with China.

What Australia must not do now is allow the PNG government to drive it into a bidding war with China to bail out the economy.

The most effective way to avoid that happening is to use our influence with both the IMF and the ADB to ensure that whatever package is agreed on is not dominated by funding, and control, from China.

The ADB has a generally good record in PNG, influenced largely by Japan, South Korea and Australia. But China is clearly playing a greater role in the bank, and of course in the IMF.

Just weeks ago, the contract for a major upgrade of the Kavieng airport in New Ireland province was awarded to the China Railway Construction Company, the latest example of the massive presence of Chinese-state-owned entities across PNG.

There may be limited support among Australians for increased aid, especially if it comes in the form of budget and debt bailouts rather than direct assistance to address health, poverty and education challenges. And we have to expect that Pacific island countries that are less resource rich, and more dependent on tourism, such as Fiji and Vanuatu, will seek Australia’s help in the coming months.

It’s overwhelmingly in Australia’s interest to help PNG and the South Pacific deal with the consequences of the coronavirus as it spreads. But we need to keep a very close eye on our neighbour’s growing economic and fiscal crisis. And we must ensure that Beijing isn’t allowed to broaden and strengthen its already extensive hold on key sectors of the PNG economy through a desperate arrangement that would not be in the interests of the people of PNG.

Print This Post

Print This Post