The roar of the paper kitten

Posted By Allan Behm on August 17, 2016 @ 15:00

Australian governments generally like to be front of mind in Beijing. But the heightened level of Chinese government awareness of things Australian, as evidenced by the editorial run by The Global Times [2] on 30 July 2016, is perhaps not quite the kind of attention that Foreign Minister Bishop courts.

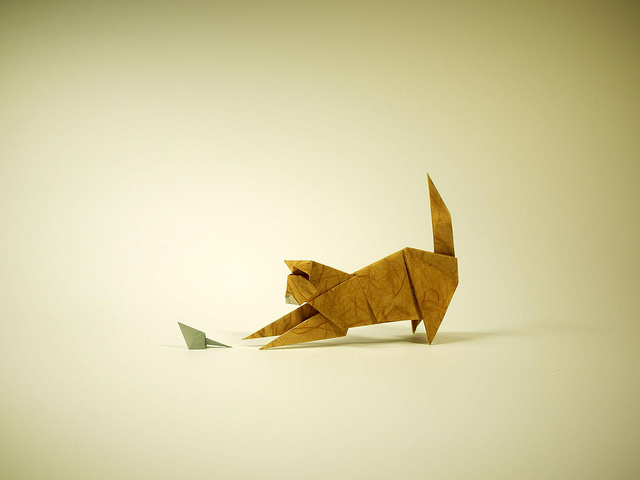

Australia’s ever-so-slightly-muscular joint statement, with Japan and the US [3], on the need for China to heed the Arbitral Tribunal’s determination on the validity of China’s South China Sea claim provoked shock-jock journalism that would certainly pass muster in some of Australia’s more flamboyant tabloids. Of course, had the Global Times editorialist a more subtle sense of humour, he might have labeled Australia a ‘paper kitten’ instead of a ‘paper cat’—if only for reasons of prosody.

Mack Horton’s spirited comments on Sun Yang’s drug history at Rio de Janiero’s Olympic pool elicited an equally cringe-worthy ‘fake news’ response from the Chinese swimming team’s manager—at least as reported by China Radio [4] International on its English language website. So, irrespective of how Australia might be succeeding in its bilateral diplomacy, we are certainly performing well on the attention-seeking front.

The government’s decision to reject the joint bid between Hong Kong’s Cheung Kong Infrastructure Holdings (CKI), controlled by Li Ka-shing, and China’s state-owned State Grid for NSW’s power distribution network, Ausgrid, extends this new malaise into the field of foreign direct investment. While it elicited a less excited commentary from China’s official mouthpiece [5], the Xinhua News Agency, it certainly attracted attention.

The rejection of the Ausgrid bid sends mixed messages, however. Why, one might ask, would the government wave through a ninety-nine year lease by a Chinese state-owned enterprise on the Port of Darwin—clearly a strategic asset—when a bid by a commercial consortium is refused on so-called security grounds? Why, one might also ask, was it permissible for Li Ka-shing’s CKI to purchase a majority stake in South Australia’s poles and wires? Is the welfare of South Australians of less security concern than that of their NSW cousins?

This is where the government displays caution rather than confidence, capriciousness rather than consistency and confusion rather than capacity—all of which could be interpreted as populist xenophobia with a tinge of political opportunism. Moreover, to shelter behind opaque ‘security concerns’ extends the lack of transparency and accountability that distinguishes the management of Australia’s refugee policy to the management of foreign direct investment.

The government’s Ausgrid decision is further evidence of the bipolar disorder that sits at the centre of Australia’s China policy, brutally expressed by former Prime Minister Tony Abbott as ‘fear and greed [6]’. If Australia is to continue to advocate the need for a rules-based international order as the critical underpinning of global political relationships, consistency would demand a domestic rules-based approach to economic and investment relationships. Quite simply, the rules must be clear.

Whether we like it or not, the fact is that many Chinese individual and corporate investors are attracted to Australian assets, be they urban real estate holdings, ports, agricultural land, pastoral leases, iron ore and coal mines, ports or transmission grids, because they want to hedge their exposure in China and in other markets.

Increasingly, Chinese investors are encouraged by the reliability of our legal system—to which they exercise increasing recourse—and the clarity of the regulations that underpin corporate, commercial and investment practice in Australia. They are also encouraged by the profitability of infrastructure assets in a largely unregulated market—a matter of increasing concern to the Australian Competition and Consumer Commissioner [7].

Rules matter. So does consistency. So too does national security. Given Australia’s reliance on foreign direct investment in maintaining economic growth, it is essential that the foreign investment guidelines are clear, equitable and non-discriminatory. To this end, it is equally important that any national security guidelines relating to foreign direct investment are at least as clear as those relating to entry to Australia by political extremists and others who might threaten harmony and security.

And this is where the problem lies: the national security principles that might inform consideration of foreign direct investment bids are totally invisible, if they exist at all. So companies that might be interested in bidding for infrastructure assets, and spending the considerable sums involved in preparing the associated documentation, are effectively flying blind. While it may be reasonable for the Treasurer to declare that, since he is the only one at a media conference holding the appropriate security clearances, he cannot divulge the precise reasons [8] for rejecting a bid, it is not reasonable that the security ground rules are ‘unknown unknowns’.

It may be amusing that Australia now carries the ‘paper kitten’ title. But it is counterproductive for Australia to act as though it is a paper kitten, toying with major investment decisions on a whim. Paranoia about China’s ability to shut down the entire NSW electricity grid is not a sound basis for considering bids from Chinese investors. Evidence that China has the intention to do so is. We evidently have some way further to travel in building a mature economic relationship with Asia’s economic powerhouse.

As China slowly redefines itself [9] in the aftermath of the ‘century of humiliation’, it will increasingly recalibrate its relationships with the West. Australia is both big enough and small enough to find itself a convenient whipping boy or, as Gideon Rachman recently wrote [10] in the Financial Times, a lightning rod for a more generalised disaffection with the West.

Article printed from The Strategist: https://www.aspistrategist.org.au

URL to article: https://www.aspistrategist.org.au/roar-paper-kitten/

URLs in this post:

[1] Image: http://www.aspistrategist.org.au/wp-content/uploads/2016/08/5990316536_a89ff5fc0a_z.jpg

[2] the editorial run by The Global Times: http://www.globaltimes.cn/content/997320.shtml

[3] joint statement, with Japan and the US: http://www.state.gov/r/pa/prs/ps/2016/07/260442.htm

[4] reported by China Radio: http://english.cri.cn/12394/2016/08/04/4001s936553.htm

[5] from China’s official mouthpiece: http://news.xinhuanet.com/english/2016-08/11/c_135587086.htm

[6] fear and greed: http://thediplomat.com/2015/04/fear-and-greed-a-closer-look-at-australias-china-policy/

[7] increasing concern to the Australian Competition and Consumer Commissioner: http://www.afr.com/news/economy/acccs-rod-sims-exasparated-as-privatisations-increase-prices-20160726-gqdyjv

[8] he cannot divulge the precise reasons: http://www.businessinsider.com.au/scott-morrison-blocks-sale-of-ausgrid-to-chinese-on-the-grounds-of-national-security-2016-8

[9] redefines itself: http://www.aspistrategist.org.au/security-dilemma-south-china-sea/

[10] recently wrote: https://www.ft.com/content/126470e0-62c5-11e6-a08a-c7ac04ef00aa?siteedition=intl&siteedition=intl&accessToken=zwAAAVaSyQXYkc8SZHDgYsUR5tOgisesBO8Aqg.MEUCIFuYtPqavQmwlTr0xbGGq6A73h2tw5mzMvsliO0_cQPbAiEAuyskXSUWxXrPQ-ZUoyadnpDq0KzbOdJoOqOHQgJans0&sharety

Click here to print.