The US Senate’s approval of the pathbreaking

United States Innovation and Competition Act on 8 June marked a new beginning in the simmering ‘tech war’ between America and China. The bipartisan support given to the bill clearly

reflects the growing anxiety among US policymakers about the rapid rise of China’s innovation capabilities and the prospect of losing American competitiveness in the years ahead. Beijing is fast closing the gap in several established technologies and aggressively pursuing self-reliance in various new and emerging technologies.

Amid Beijing’s massive state-sponsored ‘

indigenous innovation’ drive, the bill marks the return of an ‘

interventionist’ industrial strategy aimed at overhauling the US manufacturing enterprise and sustaining America’s competitive advantages. It

commits US policymakers to revive and reshore manufacturing and spend about US$200 billion on research and development and innovation over the next five years. In principle, the bill provides a

roadmap for American industries to lead innovation in future technologies and signals America’s leadership resolve to be in the innovation race for the long haul.

China’s phenomenal rise in the global trade and technology arenas over the past two decades has coincided with a

decline in America’s domestic manufacturing capacity. Riding high on the wave of economic globalisation, China has not only built strong domestic production and innovation capabilities with significant external technological input, but also displayed dynamism in growing along the value chains. In emerging

sectors such as cleantech, artificial intelligence, smart manufacturing and fintech, China’s increasing innovation leadership has directly challenged the longstanding primacy of Euro-Atlantic firms.

What’s more worrisome for global businesses, however, is the potential for Beijing’s ambitious

Made in China 2025 policies to overturn the very free-market principles that fuelled China’s rapid economic rise and to undermine their primacy through illicit means. China’s state-led market economy

model—together with Beijing’s coercive trade and technology-acquisition practices, such as theft of intellectual property, cyberespionage and

arm-twisting of international firms to part with cutting-edge technologies in return for market access—has stirred much anxiety among governments and business leaders across the Western world.

Threatened by the reported loss of valuable American intellectual property, as pointed out in various US Trade Representative

investigations, in 2019 the Trump administration slapped a slew of tariffs on Chinese goods that marked the beginning of a full-blown trade spat between China and the US. Although the two powers attempted to reach a breakthrough by signing the so-called

phase 1 trade agreement in January 2020, the thaw didn’t last long. Washington soon upped the ante against Beijing by

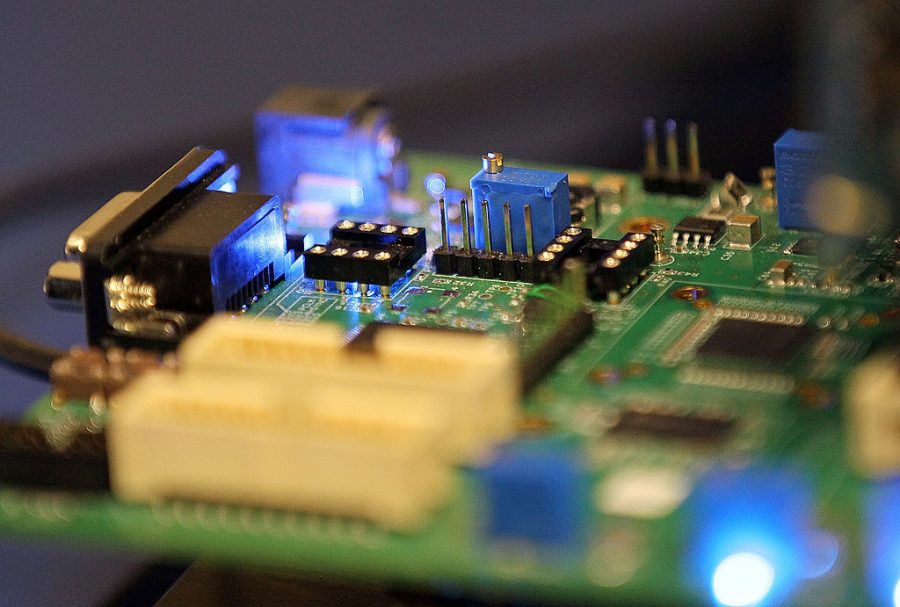

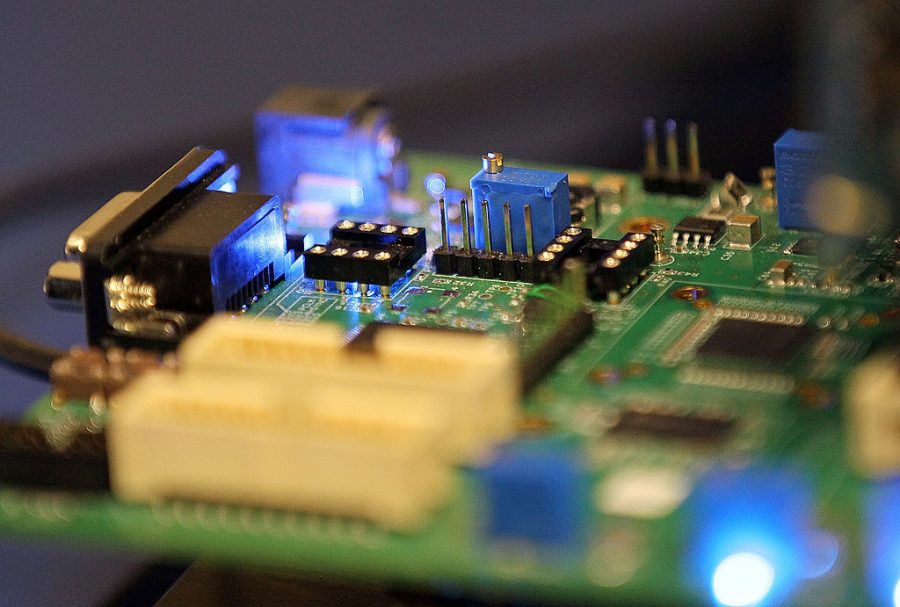

restricting exports of critical technologies like semiconductor chips to China.

Given China’s longstanding import dependence on the US for the supply of semiconductors, the export ban significantly

affected firms across the world. It forced them to delay the supply of finished goods and diversify their supply chains. As a handful of American allies currently dominate semiconductor production, US policymakers have sought to use export restrictions to reduce China’s competitiveness in manufacturing and its ability to invest in R&D and innovation in future technologies.

While the full impact of the semiconductor export ban on China remains to be seen, it’s worth noting that strategies like export restrictions don’t bode well for America’s overall trade and economic advantages. Such export-control measures have, at best, a short-term impact. And American industries, too, are likely to suffer a loss of market access, and of the accompanying scale advantages, by moving away from China. The US administration’s export ban on semiconductors is already

hurting American firms as much as their Chinese counterparts. The decline in revenues due to loss of access to Chinese markets is likely to

impair the ability of American firms to invest in cutting-edge R&D and innovation.

To stay ahead in the innovation race with China, the US will need to double down on indigenous R&D and revamp its industrial strategy so that it serves America’s interests in the long run. The US Innovation and Competition Act in this context marks a response to the perceived threat from Beijing’s Made in China 2025 plan. The bill aims to significantly increase funding for industry-relevant R&D, manufacturing and reshoring of key industries. Its successful implementation would go a long way towards sustaining the US’s competitiveness in existing technologies such as semiconductors as well as in various emerging technologies.

The US industrial policy agenda, however, is likely to increase trade frictions at the global level. Nowhere will such frictions be more intense than in multilateral institutions such as the World Trade Organization and its appellate bodies. Although the Trump administration’s decision to distance itself from the WTO and its dispute-settlement body has proved to be deeply problematic, the WTO’s future, for now, hangs in the balance as the US doles out subsidies to domestic companies and seeks to carve out new supply lines.

The Biden administration faces a difficult road in convincing its allies in Europe of the need for reforming and strengthening the WTO and forcing China to abide by the rules of global free trade. Similarly, the US faces no easy choices in dealing with the problem of cyberespionage. Safeguarding American intellectual property will require Washington to strengthen its cyber deterrence against Beijing and provide better protection of its critical infrastructure. As the bill undergoes modifications and amendments during the congressional approval process, lawmakers must consider adding provisions relating to cybersecurity R&D and innovation.

In its bid to stay competitive vis-à-vis China, Washington confronts the challenge of creating a global innovation order that is rules-based and safeguards the interests of both developed and developing countries. While strengthening its national R&D and innovation capacities and sustaining its competitive advantages, the US can forge alliances with like-minded countries such as India and contribute to building production and innovation capacities in a large swathe of the global south.

As a counter to rapacious debt-trap schemes like Beijing’s Belt and Road Initiative, Washington can lead the way in global industrial development, especially in many middle- and low-income countries, and pull them out of Chinese dependence. Forging an international economic order that is equitable, inclusive and environmentally sustainable will ultimately be critical for the wellbeing of human civilisation.

Print This Post

Print This Post