What keeps Taiwan independent? Ambiguous alliances and regular weapons purchases have so far acted as a powerful deterrent to Beijing’s desire to finally annex Taiwan into the People’s Republic of China.

But Taiwan has another tool in its arsenal—and it’s one that could make the PRC continue to hesitate to use coercive force and that could help persuade the United States to intervene if Beijing tried to invade Taiwan.

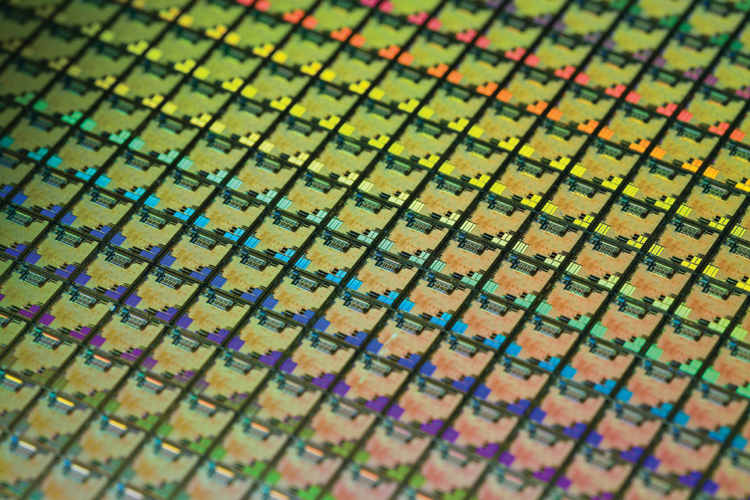

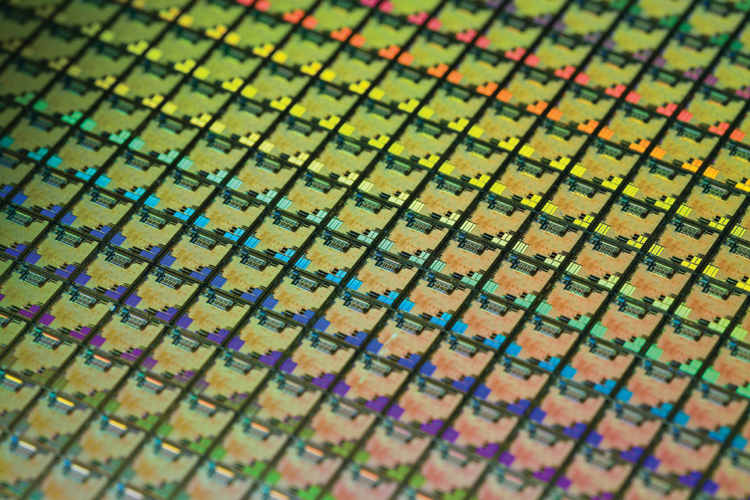

As emerging and critical technologies like 5G and the internet of things become more essential to state power, the development and production of the microprocessor chips that lie at the heart of high-tech products have become more important.

Enter

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest chip foundry, which is now a big part of the Taiwan

flashpoint between China and the US. Much like the products it produces, TSMC has more than just commercial significance for Taiwan. Access to these chips will determine states’ security capabilities over the coming decades as artificial intelligence is expected to

reshape the military landscape.

The factors that prompted former US president Donald Trump to escalate a trade war with China, which his successor Joe Biden has

inherited, include China’s history of unfair trade practices, exploitation of World Trade Organization principles, and notorious reputation for

intellectual property theft, particularly in critical and emerging technologies.

Cross-strait tensions have also increased as Beijing continues to pressure Taipei with military threats, prompting concerns that a crisis may

erupt soon. The motivations of the US and its allies to ensure Taiwan remains independent are fuelled at least in part by the need to prevent a potential global economic crisis because of the critical place TSMC has in the global supply chain of microprocessors.

Washington has justifiable concerns about Beijing’s desire to dominate this prime technology area after seeing China’s increasing

ambitions to build its capabilities and set global standards.

In a period of intensifying strategic competition, Washington can’t afford to allow Beijing to exploit technological dominance in a way that jeopardises the security of the US and its allies.

When TSMC was founded in 1987, Taiwan’s National Development Fund provided around NT$2.2 billion after the company struggled to find investors. TSMC has also benefited from the government’s provision of

affordable energy. The Ministry of Economic Affairs has not only

subsidised the whole semiconductor industry, but also specifically ensured TSMC has

stable and sufficient supplies.

And with the Taiwanese government’s success in controlling Covid-19, TSMC has been able to provide advanced chips without interruption. It has even managed to grow its

earnings while most of the rest of the world’s economy has nosedived due to the pandemic.

Despite the significant

role TSMC plays in US–China trade tensions, its importance is far beyond one coveted business entity. A recent executive order from Biden has

highlighted how vital semiconductor chips are to the US and its allies. Chinese control of such a key element in the technological supply chain would be a national security

concern for any country that China decided to oppose, especially the US.

The cost of losing TSMC to China would be difficult to bear economically as well as strategically. Foreign investors and foreign institutions

hold around 78% of the company’s shares, so cascading effects in the global stock market would be unavoidable if war were to occur.

TSMC is far

ahead of other foundry competitors. Chinese control of TSMC would turn the company into a significant bargaining chip and give Beijing much greater influence in the rare-earth minerals market.

TSMC clients such as Apple, Nvidia, Qualcomm and Advanced Micro Devices would be severely impacted, along with equipment vendors, including ASML, Applied Material and KLA-Tencor.

Companies in countries like

Japan and

Germany would likely be dragged into any turmoil involving TSMC, especially in light of recent requests to Taiwan to help alleviate a shortage of chips.

China has invested heavily in its own chip-production industry through the Semiconductor Manufacturing International Corporation, but it is still in its nascent stage. Not only is the company

incapable of competing with TSMC in the near future, but it also still

relies on it.

If China expects a significant breakthrough in its foundry industry, military coercion is a dangerous option, and it could backfire. TSMC would crucially benefit China in its competition with the US, making it one of the key factors that would drive a US response.

It’s unlikely Beijing will invade Taiwan to end the prolonged dispute over how many ‘Chinas’ there are if it also had to consider the cost of damaging the semiconductor supply chain it still relies on from Taiwan.

Taiwan has been preparing for a possible invasion since 1949 and it wouldn’t be an easy task for the People’s Liberation Army to pull off. A war would be costly in Taiwanese lives and infrastructure. The importance of TSMC as a major player in a critical global supply chain for both China and the US should give both sides pause for thought as tensions rise, because both would stand to lose.

Print This Post

Print This Post