The Australian Department of Defence has a continuing attraction for the US Foreign Military Sales (FMS) office. The attraction can readily be seen in the ongoing trend towards an ever-increasing commitment of the defence budget direct to the US. For the past four years I’ve been analysing where Defence contracts are placed, as it illuminates a number of key issues associated with the local defence industry.

As a point of background my analysis was originally confined to the (now-defunct) Defence Materiel Organisation but has since been extended to cover all contracts placed by both the DMO and the Department in the period 1 July 2007 to 30 June 2016. It involves approximately 300,000 separate contracts worth about $183 billion. The data has been obtained from Austender and is therefore publicly available.

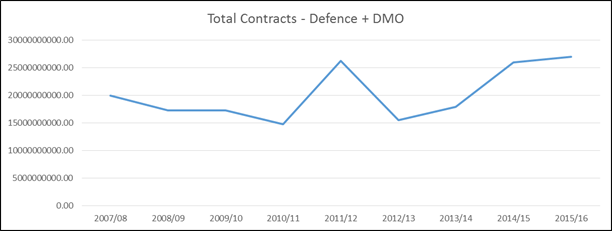

The first point to note from the data is that, since the low point in 2012–13, the Australian government has increased the total amount committed in Defence-related contracts (as shown in Figure 1 below). That’s an unambiguously good result given the reductions from the previous Labor governments. The prognosis from the 2015–16 budget over the forward estimates continues this overall trend.

Figure 1: Total Contracts Awarded by Defence + DMO (2007-08 – 2015-16)

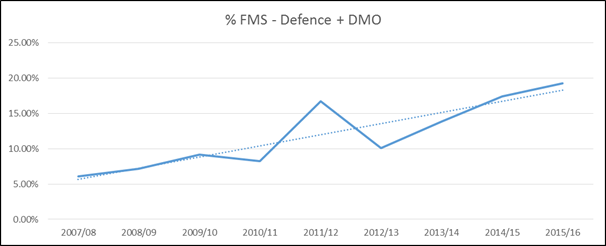

While the total contract commitment trends are positive, the headline figures hide what’s happening with the FMS office and other contract mechanisms direct to the US government. Figure 2 below clearly shows the ongoing and increasing use of these mechanisms by the Department of Defence for acquisition and sustainment. The commitment through FMS and related channels has risen from about 6% of total contracts (by value) in 2007–08 to nearly 20% in 2015–16, with no sign that the trend is abating.

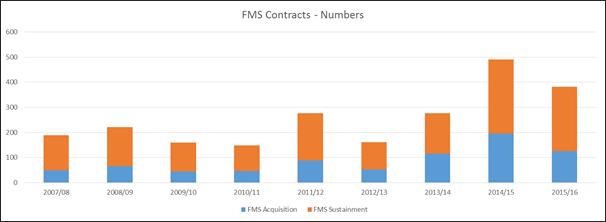

Some might argue that the increase is due to some big ticket items such as the Joint Strike Fighter and Poseidon, and to a certain extent that’s true. Figure 3 however shows that it’s not only the overall commitment through FMS that’s on the rise, but the number of separately executed contracts for both acquistion and sustainment has also increased over the analysis period, thereby showing that dominance by a few very large contracts isn’t the driver. Rather, increasingly, Defence seems to be approaching FMS as the contracting mechanism of choice.

This issue isn’t necessarily with the equipment acquisition (after all there are limited avenues through which to buy an F-35) but in the associated sustainment. Commitment to sustainment through FMS does little to build capabilities in Australia for the support of systems that the ADF operates, and a cursory examination of recent FMS contracts shows sustainment elements that range from 12%–56% of the total value. In addition, during the immediate past financial year Defence entered into a single sustainment contract for Super Hornet and Growler worth $1.5 billion, and another for AWD sustainment at the value of $275 million. Such offshore commitments would seem to be contradictory to the opening words in the 2016 Defence Industry Policy Statement that ‘Australia’s defence industry is essential to the operations of the Australian Defence Force (ADF) and to the capability we need to protect Australia and our national interests’, to the government’s stated commitment to build a new partnership between industry and Defence, and to the recognition of industry as a Fundamental Input to Capability.

Figure 2: Percentage of Defence (and DMO) contracts (by value) awarded direct to US government

Figure 3: Number of separately executed contracts with US government

US State Department figures show that the Australian use of FMS up to 2010 was higher than comparable US allies—it was double that of South Korea and Japan, and almost ten times higher than Canada and the United Kingdom. In fact the same State Department statistics show that only Iraq, Qatar and the UAE utilised FMS more than Australia in 2010. On Austender data our utilisation of direct contracting to the US Government has doubled since that time.

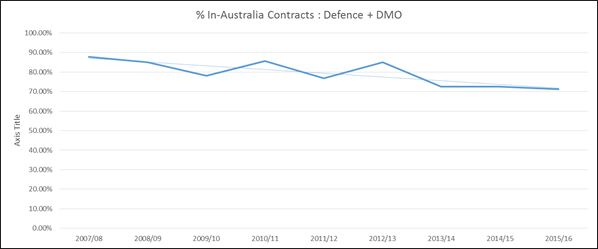

‘So what?’, you might say—after all, the ADF front-end requires the best capability. That’s true, but money can’t be spent twice, and therefore there must be at least one other corresponding trend. In this case it’s the steady reduction in the amount of money the Department of Defence contracts to companies operating within Australia. That’s shown at Figure 4—and covers Australian-owned companies and the on-shore entities of offshore businesses. There’s an almost perfect match in the underlying trends between Figures 2 and 4. That indicates that the percentage of contracts awarded to non-FMS entities offshore has essentially remained static and that Australian-operating companies have borne the brunt of the increasing attraction of FMS.

Figure 4: Percentage of Defence + DMO contracts (by value) awarded to Australian-operating entities

The capability of the local defence industry is a pre-requisite for successful military preparedness. That’s the essence of what ‘Industry as a Capability’ actually means. On current trends the Australian defence industry is on the road to nowhere. Unless ‘Industry as a Capability’ is addressed now, the Australian government will lose the ability to employ a realistic military option should one be required to safeguard our territorial sovereignty or pursue our sovereign interests.