China’s live-fire drills surrounding Taiwan over the weekend simulated an economic blockade, with Chinese forces positioned to halt access to the island nation’s main ports. Dozens of ships heading to or from North Asia were …

Beijing’s creation of a new state-owned company to centralise China’s purchases of iron ore and other metal resources is unlikely to have much impact while markets are tight and prices are high, but it could …

Beijing will be keeping a close watch on the G7’s efforts to cap the price of Russian oil because China is trying to do the same to Australian iron ore. As the world’s biggest exporter …

The virtual summit of BRICS leaders in Beijing late last month brought a slew of proposals to strengthen the group’s economic and geopolitical influence. Russian President Vladimir Putin unveiled a plan for a new reserve currency …

China’s trade surplus hit an extraordinary US$292 billion in the first five months of the year—more than double its pre-pandemic level—and its aggressive pursuit of export markets is likely to become a flashpoint in a …

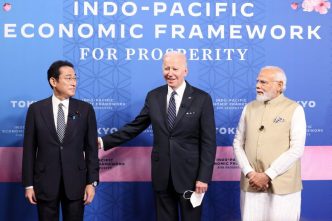

The Biden administration attracted a dozen nations to the launch of its Indo-Pacific Economic Framework but the lack of commitment to the plan from either the United States or the region suggests it’s unlikely to …

The impact of the Russia–Ukraine war on global food supplies is being magnified by nations imposing bans on food and fertiliser exports to preserve stocks for their domestic needs. Since the invasion, 15 nations have …

Australian-based financial institutions have almost doubled their use of Chinese funding over the past three years to $46.7 billion, with Chinese investors liking the returns on offer despite the deep-freeze in bilateral trade and diplomatic …

Australia is Russia’s closest competitor in global markets and is the obvious winner as Russia loses sales under the impact of international sanctions. Since the beginning of the year, the average price of Australia’s biggest …

President Joe Biden announced last week that the US will tap into its emergency oil reserves to minimise the blowback to the US economy from its sanctions on Russia. That move will go some way …

China and Russia may be allies in autocracy, but their attitudes towards engagement with the global economy could not be more different. Whereas Vladimir Putin has devoted the past 20 years to making Russia’s economy …

Russian President Vladimir Putin aspires to be leader of the great power of Eurasia rivalling China to its east and the European Union and the United States to its west. Yet the latest analysis from …