As commentators continue to assess the significance of the Chinese Navy’s recent ‘Christmas Island cruise’, a sub-strand of anxiety focuses on Beijing’s growing influence in the South Pacific.

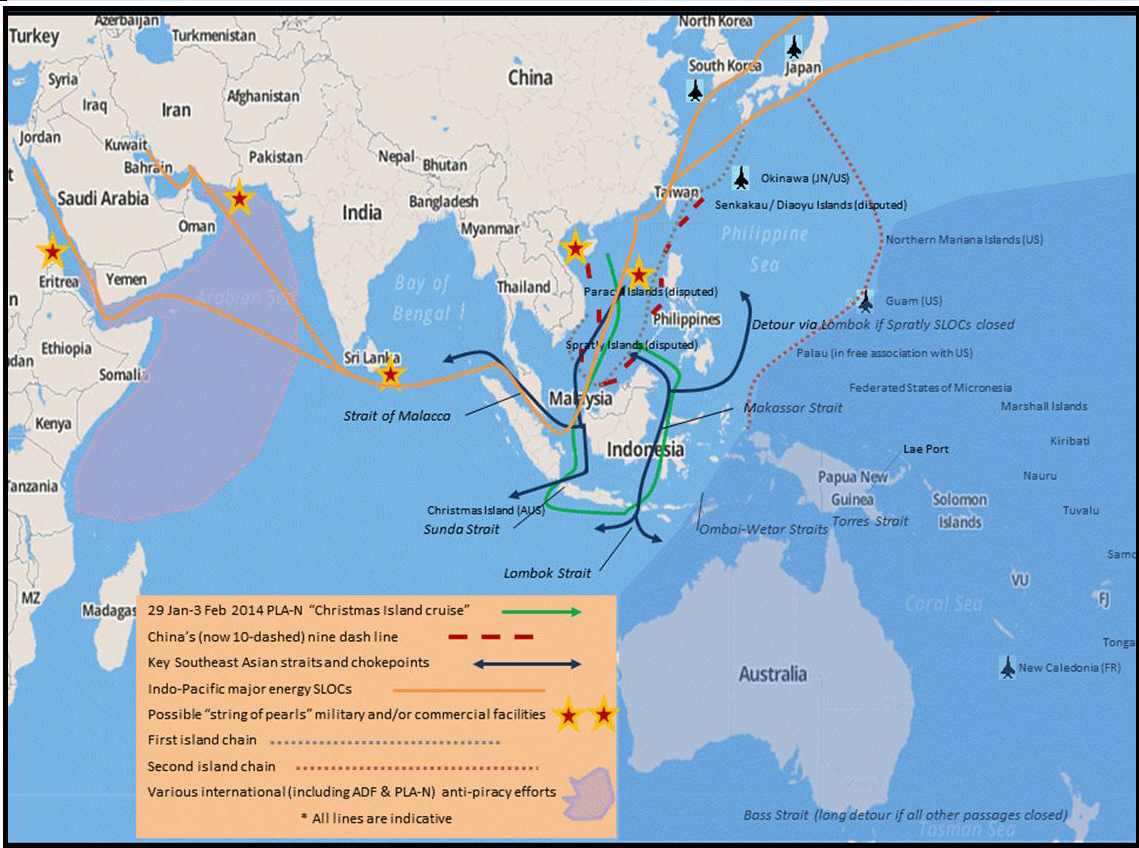

The NZ Herald, for example, worries that China’s development and expansion of ports in Tonga and PNG gives it unprecedented presence in our neighbourhood. That concern appears to partly reflect a far-from-mainstream view that Beijing wants to establish a second ‘string of pearls’, this time across the Pacific Islands, in order to complement the seemingly more tangible network of military and commercial facilities along its crucial Indo-Pacific energy sea lines of communication. Still, the ever-sober Radio National’s attention to the implications of the Chinese exercise for the Pacific suggests the topic deserves a look.

Last May, I suggested Jenny Hayward-Jones’ Lowy paper Big Enough for All of Us: Geo-Strategic Competition in the Pacific Islands would become the essential starting point for any following survey of what China’s increasing diplomatic reach and economic clout may mean for the region. The PLA-N steaming three vessels through the Sunda and Lombok Straits, conducting standard military training in international waters (they’d seemed more provocative in disputed parts of the South China Sea earlier in the cruise), or developing capabilities commensurate with China’s stake in global maritime security doesn’t change my view of what Beijing’s up to near its own shores. I still think Jenny’s right to say China doesn’t have aggressive designs in the South Pacific, but from a strategic perspective, I think that’s rather beside the point: its growing local presence and clout can complicate our interests even it doesn’t try, or even want, to supersede us. The Christmas Island cruise illustrates that point.

David Wroe got a bit carried away in the Fairfax press, describing the three vessels as a ‘flotilla’, referring to an earlier sortie ‘breaching’ the first island chain when no-one was trying to contain it, and suggesting a Chinese naval drill has never come so close to Australia. The RAN and PLA-N conduct joint passage exercises and modest confidence building activities when Chinese vessels visit Australian and NZ ports. But he’s right on the mark to suggest that the voyage crystallises ‘Australia’s new defence reality’ of Beijing’s growing military might. Foreign Minister Bishop also recognised we’re in a ‘very different world’ with a ‘changing landscape’. Hugh White argues that response suggests she’s ‘got the message’ from Beijing, and that it’s possible she’s pulling her diplomatic punches. But it’s just as likely she sees a qualitative difference between a voyage carried out under accepted norms and the aggressive way Beijing announced its ADIZ, which she protested.

Should we, then, worry that Chinese involvement in major South Pacific transport infrastructure is intended to provide a strategic ‘foothold’? The evidence suggests not. The most obvious candidate for concern would be the quarter of a billion dollar major redevelopment of Lae Port by the state-owned China Harbour Engineering Company in PNG’s economically critical city and the gateway to the populous highlands. But as Hayward-Jones shows, such investment and work tends to be driven by individual provinces or state owned companies intended first and foremost to make profits and deliver jobs for Chinese workers rather than systematically advance China’s strategic interests. (In Lae Port’s case, the project has mainly been funded by the Asian Development Bank, with the PNG Government providing additional funds and significant oversight.)

China’s aims are no doubt complex, aren’t easily divined, and could obviously change. But a look at the map shows the port project a long way east of China’s crucial energy and major trade routes or supposed ‘string of pearls’ facilities. The port also sits well inside a region that still contains a large, permanent and scalable US, Australian, NZ and French military presence, and where many host governments have longstanding close security partnerships with those ‘traditional’ powers.

But strategists sometimes worry less about intent and more about capability. So, even if we conclude that activities such as major infrastructure projects are conducted for mainly commercial reasons, what might the Christmas Island cruise say about Beijing’s capability to project military power into the South Pacific? In most senses, not much we didn’t already know, though the voyage brings China’s capacity into sharper focus. To keep things in perspective, the new Type 71 amphibious ship at the centre of the exercise, the Changbai Shan, is nearly a third smaller than the LHDs we’re acquiring. And as White reminds us, ‘what navies can do in peacetime is a poor guide to what they could do in a war’. But Beijing intends to commission six or more of the class and build more capable vessels in the future, while the Type 71s have a potent reach for contingencies short of war between major powers—not what we’re really worried about in the South Pacific—carrying a battalion of Marines, four large transport helicopters, and medium assault craft.

So while there’s no need to hyperventilate, China’s growing reach does complicate our strategic calculus. Scenarios that seemed outlandish a few years ago, such as the PLA evacuating its nationals if they were targeted in civil strife, while still unlikely, no longer seem so far-fetched and will soon be technically feasible. We’d rescue our own people if we had to. But what would we do if a friendly country in crisis sought our help to prevent a Chinese military led evacuation they weren’t comfortable with? And how would we react if Beijing sortied a real flotilla into the region to signal it was unhappy with us?

To avoid having to answer such questions, we need to further lift our game, harnessing all our trade, aid, security, and other instruments of national power, as well as our relationships with regional countries, to prevent friction arising in the first place.

Karl Claxton is an analyst at ASPI. Map (c) ASPI 2014.