Ideas about the future lie at the heart of strategic thinking. As major capability acquisitions often take years to decide or implement, and countries are stuck with the results for decades, strategy is partly governed by expectations about how the international setting will look 10, 20 and 30 years ahead.

Although partners’ and potential adversaries’ intent can change more quickly than their capabilities, necessitating prudent hedging against unlikely but credible strategic deterioration, many relationships have sufficient positive or negative ballast to appear fairly steady under international law and norms. Slow-changing cultural, socio-economic and geographical features mean we can be pretty confident Australia won’t come to blows with New Zealand, will remain locked in a mutually beneficial but periodically rocky partnership with Indonesia, and need to be able to consider making a proportionate contribution to an international military coalition as long as North Korea endures, for example.

Interests, values, and relative strength, however, obviously evolve over time. Canberra’s anxiety level about its diplomatic quarrel with Jakarta probably partly reflects Prime Minister Abbott’s assessment, before the crisis, that ‘it probably won’t be very long before Indonesia’s total GDP dwarfs ours’. Other relationships are more unpredictable or prone to miscalculation and mismanagement.

The US National Intelligence Committee (NIC) approximates future global power on the basis of countries’ predicted GDP, population size, military spending, and technology, combined with some less obvious elements such as health, education, demography, and governance, and even intangibles of soft power sway. Among these, military muscle can occasionally still allow one party to compel another to take a particular course without a more transactional exchange but economic strength seems the key enabling ingredient for even that clout—it’s ‘the foundation of national power’.

Caveats abound when one dusts off the crystal ball. We are warned to avoid straight-line extrapolation, resist mistaking GDP performance for wealth (which accumulates and ebbs in human capital, investment, and national resilience over decades); expect strategic surprises, and generally beware predictions as a graveyard of reputations. But simple tennis-ladder rankings can provide a starting point for exploring where power lies and may be heading. And although being above the middle of a table of 200 countries ‘isn’t setting the bar very high’, looking at just the top 20 or 30 places might even begin to bring the slippery concept of middle power into focus (click to enlarge):

Figure 1 compiled from Wikipedia tables

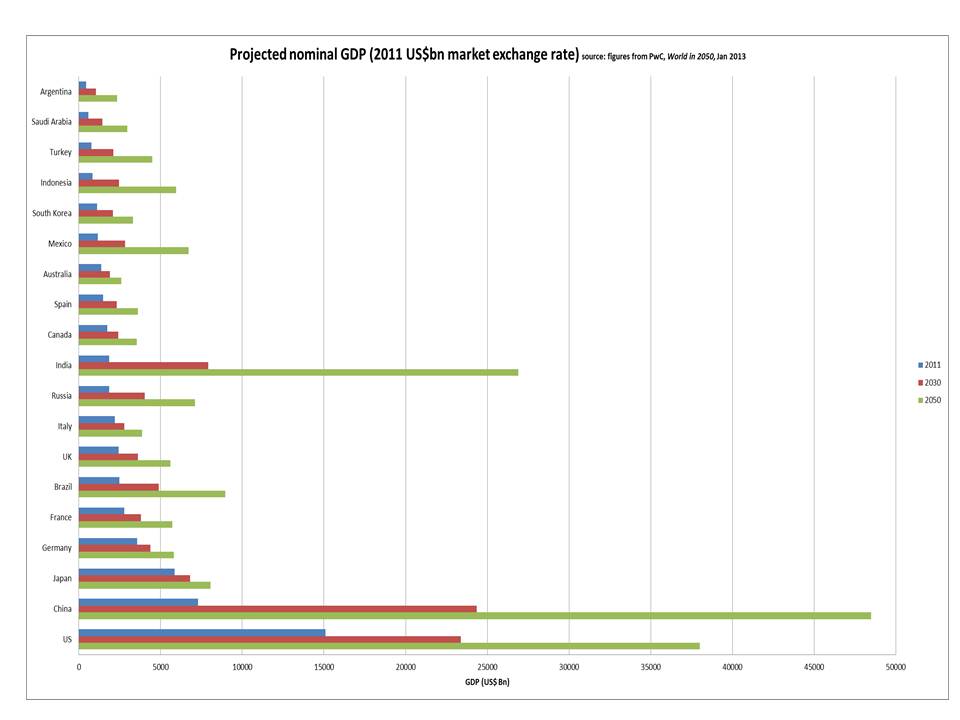

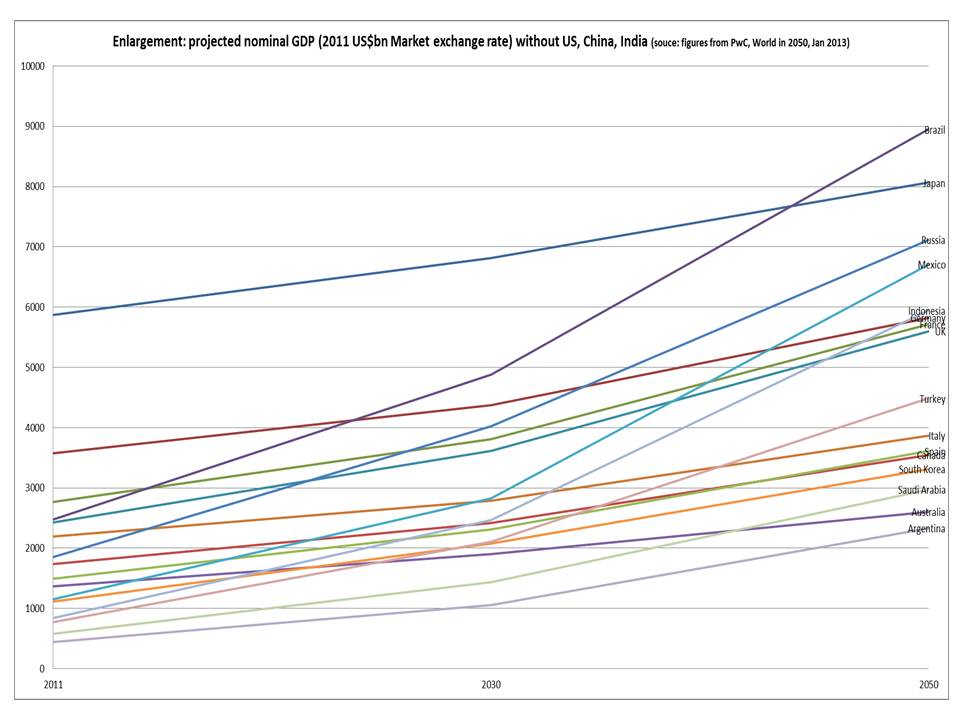

Looking ahead, a PricewaterhouseCoopers forecast of the crucial economic variable projects China overtaking the US as the world’s largest economy in terms of nominal GDP at market exchange rates just before 2030, and Indonesia overtaking Australia before then (click to enlarge):

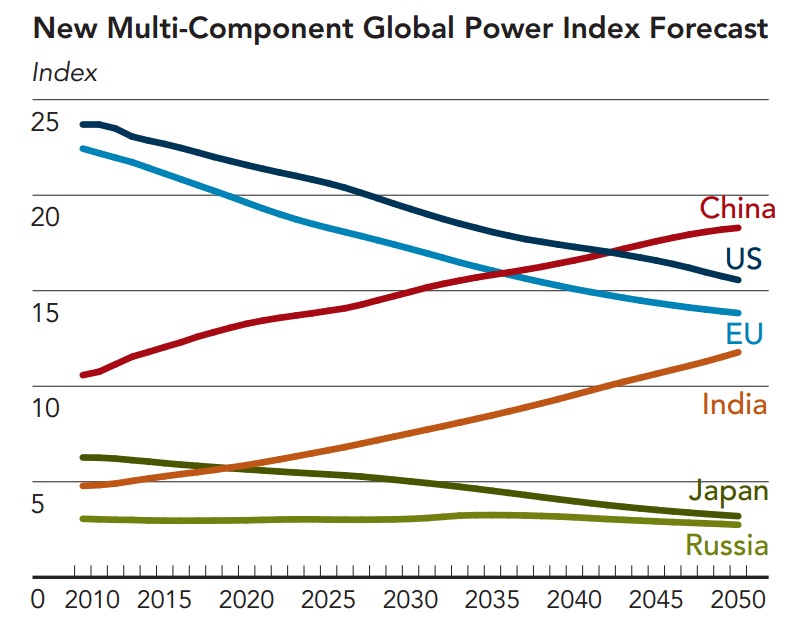

And looking beyond relative affluence alone, the NIC suggests seven ‘tectonic shifts’—growing middle classes; wider access to new (including lethal/disruptive) technologies; aging populations; demand for food and water; urbanisation; shifting economic power; and US energy independence—will interact with the fiscal, demographic, military and technological drivers of national power to shape the future:

And looking beyond relative affluence alone, the NIC suggests seven ‘tectonic shifts’—growing middle classes; wider access to new (including lethal/disruptive) technologies; aging populations; demand for food and water; urbanisation; shifting economic power; and US energy independence—will interact with the fiscal, demographic, military and technological drivers of national power to shape the future:

Figure 4 source: National Intelligence Council’s Global Trends 2030: Alternative Worlds report

Figure 4 source: National Intelligence Council’s Global Trends 2030: Alternative Worlds report

Beside Indonesia, other regional countries, such as Malaysia, Thailand, and Vietnam, may also have the potential lent by the combination of large populations and growing economies and human capital.

So what does this mean for Australia’s future defence and security? In 2009, Hugh White suggested that in view of the erosion of American power associated with the rise of China ‘we cannot afford the capabilities to achieve the objectives that would help us manage emerging strategic risks at 2% of GDP’ (noting we spent around 3.2% on defence during the 1950s and 60s). In 2011, Ross Babbage argued there was a case to ‘boost defence expenditure quite significantly’ above 2%. In contrast, Paul Dibb has just proposed the next Defence White Paper revisit the relevance of and timetable for Joint Strike Fighters, submarines, and other major components of the Defence Capability Plan, in the absence of a clear imminent threat and in view of the period of austerity we’re entering.

I’d be inclined to stick with a middle-of-the-road approach, unless China’s declaration of its ADIZ in the East China Sea marks an intent to contest rather than signal territorial claims (it’s arguably already meant Japan’s insistence there’s no dispute looks pretty shaky). Although nearer neighbours’ growth will also make it harder, in the long term, to ‘keep up with the Jonses’, or rather stay ahead of them via our accustomed hi-tech edge, the complexity and cost of key inputs to capability means the gap will narrow slowly. The ADF’s ability to overmatch any nearby country that tried to project power directly against us should remain sustainable, with modest investment, for quite some time. And while economic clout provides the central component of national power, it’s still just one measure: our GDP was larger than ASEAN countries’ combined until the early 1980s but Australia’s greatest post-World War II perils occurred in the early 1960s with Konfrontasi, Indonesia’s acquisition of modern Soviet weapons, and its expansion into West Papua, as well as the escalation of the Vietnam conflict (resulting in the order of submarines, destroyers, and F-111s whose ‘raison d’etre had evaporated’ by the time they entered service but which provided strategic reassurance for decades to come).

In this broad setting, ASPI colleagues have set out a range of cost-effective capability, warning-time, alliance, and regional engagement strategies to help maintain the ADF’s edge, enmeshment with nearby militaries, and ability to conduct likely regional tasks.

Karl Claxton is an analyst at ASPI.