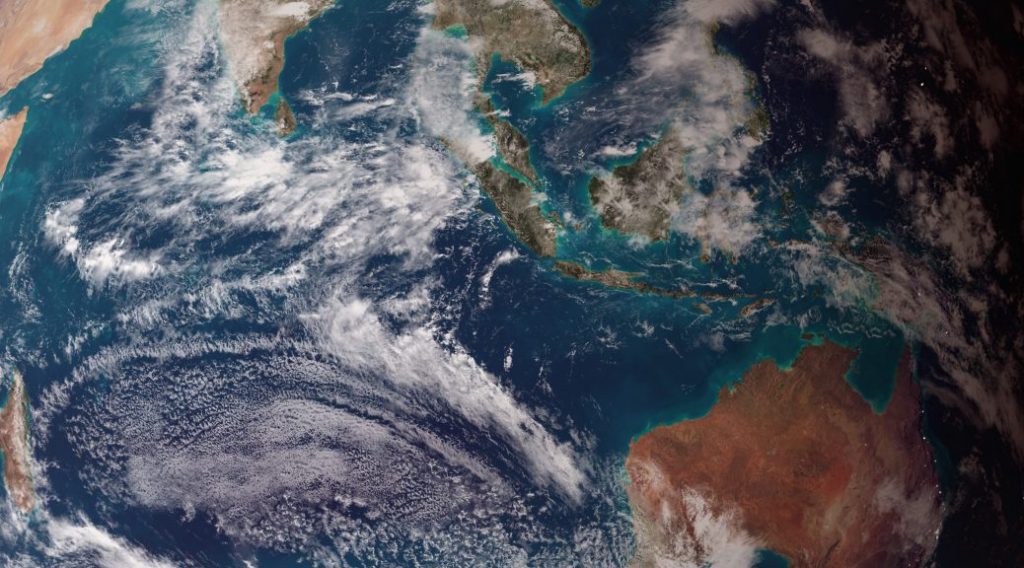

Amid the many political crises of 2020, progress towards the Regional Comprehensive Economic Partnership has attracted practically no attention. Yet this ‘mega-regional’ free trade agreement is of massive significance for the Indo-Pacific. On arrival, RCEP will be the world’s second most important trade agreement, behind only the World Trade Organization itself.

If RCEP is completed during the November summit season—as now seems likely—it will remake the economic and strategic map of the region.

RCEP is a multilateral trade agreement comprising 15 Indo-Pacific countries: Australia, China, Japan, Korea, New Zealand and the 10 ASEAN members. Its objective is to harmonise the existing network of ‘ASEAN+1’ FTAs into a unified agreement, creating a single and cohesive set of trade rules for the Indo-Pacific. It also includes regulatory provisions for many ‘21st century’ trade issues, such as services, investment, e-commerce, telecommunications and intellectual property.

With such an economically and politically diverse group of participants, RCEP negotiations have been a herculean effort. Since the agreement was first mooted in 2011, the parties have completed 31 rounds of negotiations and held 18 ministerial meetings. The ‘text’—that is, the regulatory components—was settled in late 2019, and the market access provisions were finalised this year.

RCEP has also survived the Covid-19 crisis largely unscathed, with negotiations shifting to a virtual modality from April. The members intend to sign the agreement following the 2020 ASEAN summit, provisionally scheduled for early November.

On many counts, RCEP will be the most important regional trade agreement ever signed. By population and economic size it will be the largest regional bloc in existence, accounting for just under a third of world GDP.

Measured in terms of world trade, its 29% share is only a fraction smaller than the EU Customs Union’s 33% share. And RCEP will soon overtake Europe as Indo-Pacific economies rapidly deepen their trade orientation.

Comparison of regional trade blocs, 2019

| Year established | Member states | Population (millions) | Share of world GDP (%) | Share of world trade (%) | |

| Comprehensive and Progressive Agreement for the Trans-Pacific Partnership | 2018 | 11 | 504 | 12.9 | 15.3 |

| ASEAN FTA | 1992 | 10 | 654 | 3.5 | 7.4 |

| Commonwealth of Independent States FTA | 2011 | 8 | 244 | 2.4 | 3.1 |

| EC/EU Customs Union | 1958/94 | 28 | 513 | 21.9 | 33.1 |

| Common Market of the South (Mercosur) | 1991 | 5 | 293 | 3.1 | 1.8 |

| North American FTA | 1994 | 3 | 493 | 27.6 | 13.2 |

| Regional Comprehensive Economic Partnership | Expected 2020 | 15 | 2,290 | 29.1 | 28.7 |

The fact that RCEP is moving towards completion is in itself a historic diplomatic achievement. Since the launch of the project over a decade ago, negotiations have persisted despite a wide array of political headwinds, including a global turn towards protectionism, which has seen governments move to restrain rather than liberalise trade policy settings. It has also faced increasing diplomatic assertiveness from China, which has led to a deterioration in Beijing’s political relations with many Indo-Pacific governments.

Competition with Trans-Pacific Partnership negotiations preoccupied several members (particularly Australia, Japan and Vietnam) until 2018. And India’s decision to withdraw in late 2019 forced a strategic reset of negotiating objectives.

The Covid-19 crisis has further distracted policymakers and intensified protectionist impulses.

That the largest-ever regional trade agreement will be delivered against this hostile backdrop is a testament to the commitment of Indo-Pacific governments to rules-based economic integration.

Equally important, RCEP will also redraw the strategic map of the Indo-Pacific. The existence of a single, regionwide set of trade rules will change the economic outlook of its members. With barriers to intraregional trade and investment lowered, members will accord higher priority to deepening economic ties among themselves. Pursuing extraregional economic ties will fall in relative importance.

In a context of partial US–China economic decoupling, RCEP will change the calculus of many governments towards within-region responses.

It will also lock in multilateralism and ASEAN centrality in the regional economic architecture. While it is often claimed that RCEP is a ‘China-led’ agreement, the reality is that it is an ASEAN-led initiative. It is built on the foundation of the six ASEAN+1 FTAs and secures ASEAN’s position at the heart of regional economic institutions.

It also binds China to a multilateral model for trade liberalisation, which breaks with its preference for bilateral economic diplomacy (seen in the Belt and Road Initiative). The presence of developed countries (Australia, Japan and Korea) and large developing countries (Indonesia and Vietnam) also provides a collective hedge against fears of Chinese economic dominance.

Unfortunately, RCEP will add to India’s exclusion from the Indo-Pacific economic architecture. New Delhi’s withdrawal from negotiations was due to India’s inability to match the market access commitments of other members. This reflects the country’s more protectionist trade policy settings, and claimed fears of a ‘Chinese import surge’ if it joined the agreement as proposed.

However, it augurs poorly for India’s economic integration with Indo-Pacific partners, which was already very low because of its less open policy settings. RCEP will include an accession mechanism that keeps the door open to India joining if economic and political factors change.

RCEP will also provide a fillip to regional post-Covid-19 recovery efforts. The pandemic has interrupted many cross-border value chains, which are critical for the open economies of the Indo-Pacific. By lowering trade barriers—at a time when most of the world is raising them—the agreement will send a strong message that the Indo-Pacific is still open for business. And by harmonising national trade practices around common regional standards, it will make it much easier and faster to re-establish value chains once Covid-19 eases. With RCEP, the Indo-Pacific will return to economic dynamism faster than any other region in the world.