In an ASPI report released today, we argue that geopolitical challenges, notably Beijing’s growing power and coercive behaviour, justify a greater effort to elevate and sustain the important relationship between Australia and South Korea.

Changes led by President Yoon Suk-yeol, who aspires to make South Korea a ‘global pivotal state’, challenge the view that Seoul lacks the bandwidth to tackle security beyond the Korean peninsula. Initiatives like the South Korea–US–Japan trilateral launched by the three leaders at Camp David in August show that Seoul is willing to take steps to strengthen its security partnerships even if that risks upsetting Beijing.

Australia is also looking to achieve more with South Korea, overcoming years of underperformance and inconsistency in bilateral relations. Deputy Prime Minister and Defence Minister Richard Marles told an audience in Seoul last week, ‘As mature liberal democracies, I’m convinced the strategic defence relationship between Australia and South Korea can go from strength to strength and is full of opportunities to deepen it even further. I’m visiting here for the second time in a year to act on that conviction.’ It’s a shame that the response to Hamas’s attacks against Israel prevented Foreign Minister Penny Wong from joining Marles in Seoul last week, but hopefully the annual Australia–South Korea 2+2 foreign and defence ministers’ meeting can take place later this year.

Our report makes six recommendations to boost collaboration between Australia and South Korea, both bilaterally and with a wider set of regional partners. These recommendations span the three pillars of 2021 Australia–Republic of Korea Comprehensive Strategic Partnership: strategic and security cooperation; economic, innovation and technology cooperation; and people-to-people links.

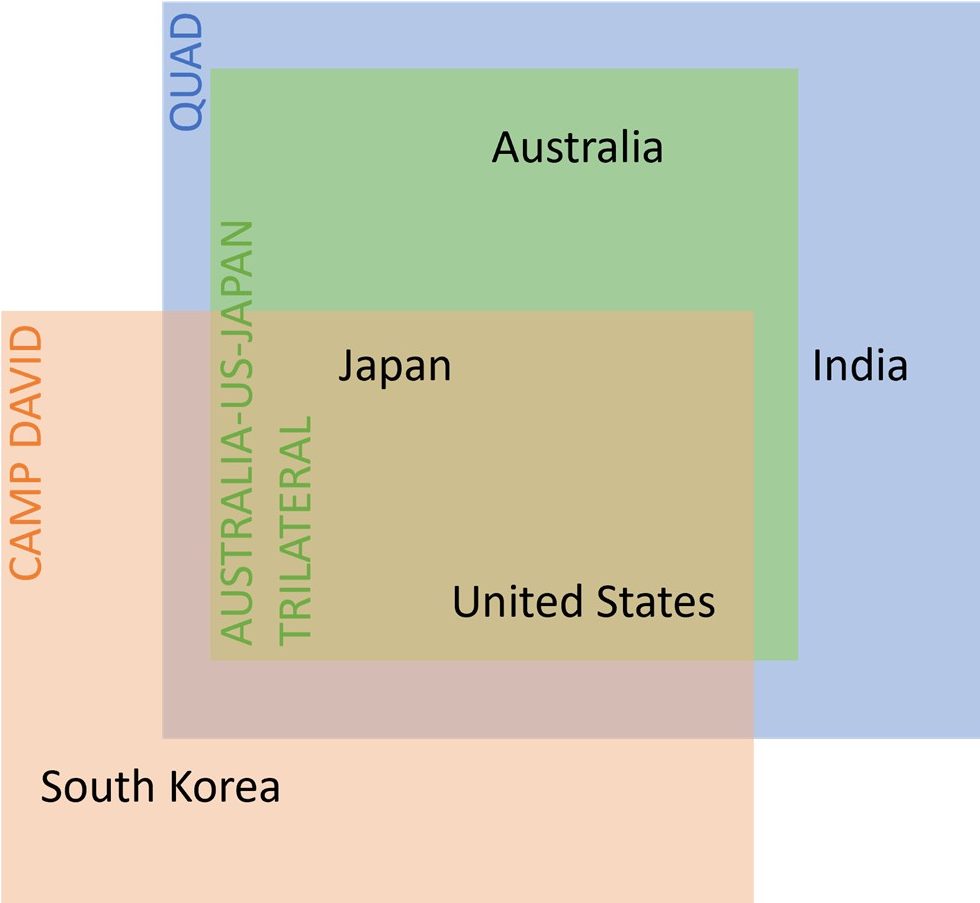

Under the strategic and security pillar, Australia and South Korea should explore ways to incrementally knit together the longstanding Australia–US–Japan trilateral, which includes the Trilateral Strategic Dialogue between foreign ministers and the Trilateral Defence Ministers’ Meeting, with the nascent Camp David trilateral (see Figure 1). This process mustn’t be rushed and should start with engagement between officials rather than ministers. One option would be to invite Australia as a guest to the annual Trilateral Indo-Pacific Dialogue, a senior-official-level meeting for coordinating implementation of national Indo-Pacific strategies, especially as they apply to Southeast Asia and the Pacific island countries.

Figure 1: South Korea’s and Australia’s engagement in major regional minilaterals

As well as increasing military interoperability and joint exercises, defence industry collaborations like Hanwha Defence’s armoured vehicle centre of excellence in Geelong should be supported by Australia’s forthcoming defence industry development strategy, which requires a broad definition of sovereign capability focused on the resilience of supply rather than Australian ownership.

Cooperation under the economic, innovation and technology pillar of the partnership is key to countering Chinese coercion, which Australia and South Korea have both experienced. Both countries have responded to coercion by diversifying their trade relationships and improving supply-chain resilience in sectors like critical minerals and technologies. In this context, Australia and South Korea should support collaboration relevant to the advanced capabilities stream of the AUKUS agreement, focusing on defence-relevant technologies in which both countries are among the leaders in publishing high-impact research (see Table 1).

Table 1: Defence-relevant technologies on which Australia and South Korea should collaboratea

| Defence-relevant technologies | Proportion of high-impact research output (%) | Technology monopoly riskb | ||||

| China | Second leading country | South Korea | Australia | South Korea and Australia | ||

| Sonar and acoustic sensors | 49.4 | 12.5 | 2.8 | 1.6 | 4.4 | High |

| Electronic warfare | 46.0 | 14.4 | 3.6 | 2.3 | 5.9 | High |

| Novel metamaterials | 45.6 | 16.9 | 4.0 | 3.0 | 7.0 | Medium |

| Directed-energy technologies | 39.1 | 19.1 | 5.9 | 1.9 | 7.8 | Medium |

| Machine learning | 33.2 | 17.9 | 3.3 | 2.7 | 6.0 | Low |

| Adversarial AI | 30.9 | 25.2 | 3.5 | 4.9 | 8.4 | Low |

| Protective cybersecurity technologies | 22.3 | 16.8 | 2.7 | 5.7 | 8.4 | Low |

| Autonomous systems operation technology | 26.2 | 21.0 | 3.6 | 3.2 | 6.8 | Low |

| Advanced robotics | 27.9 | 24.6 | 3.8 | 2.8 | 6.6 | Low |

Notes:

a. The technologies in this table were chosen because they are listed as defence-relevant technologies in ASPI’s Critical Technology Tracker. However, only the technologies that fulfilled the following two criteria were chosen: China ranked first in terms of proportion of high-impact research, and South Korea and Australia ranked in the top 10 countries in terms of proportion of high-impact research output.

b. The technology monopoly risk metric seeks to highlight concentrations of technological expertise in a single country. It incorporates two factors: how far ahead the leading country (in this case, China) is relative to the next closest competitor, and how many of the world’s top 10 research institutions are located in the leading country (China). This metric, based on top 10% research output, is intended as a leading indicator for potential future dominance in technology capability (such as military and intelligence capability).

Source: Critical Technology Tracker, ASPI, 2023.

Canberra and Seoul could also do more to capitalise on their complementary strengths in space technologies, including small satellites. South Korea launched its first commercial-grade satellite in May 2023 and ranks highly in satellite-related research according to ASPI’s Critical Technology Tracker. Northern Australia’s advantageous geography makes it the perfect location for cooperation on space launches and co-development of small satellite technologies with applications such as intelligence, surveillance and reconnaissance; missile early warning; and communications.

Drawing back the lens to capture wider priorities, the two countries should play a leadership role in the Indo-Pacific region’s clean-energy transition, including through technical and development assistance focused on green hydrogen. This would also help address South Korea’s reliance on Australian coal and gas, and assist both countries meet their 2050 net-zero-emissions targets. By working together, they could support the development of regional supply chains for critical minerals used in clean-energy technologies, such as lithium, further improving resilience to Chinese coercion.

The people-to-people pillar of the partnership probably receives the least government attention, but it is vital and evolving rapidly. South Korea’s soft-power ascendancy includes the attraction of Hallyu (the ‘Korean wave’) to many Australians, which has driven interest in South Korea and the expansion of Korean studies in Australia. South Korea was the third most popular destination for Australians participating in the Department of Foreign Affairs and Trade’s New Colombo Plan program in 2023. In contrast, Yonsei University is the only South Korean university to host an Australian studies centre. DFAT could craft an ‘Australia now’ campaign that engages Korean Australians who are famous or leaders in their field, including in the K-pop industry, as cultural ambassadors to address the imbalance and promote interest in Australia among the South Korean public.

The convergence of Australian and South Korean strategic interests on the challenge posed by China underpins recent progress in the bilateral relationship and lays the foundations to go further. The right investments now could help insulate this crucial strategic partnership from the risk of backsliding if there’s a change in the political wind—an approach that sounds familiar as Prime Minister Anthony Albanese visits Washington.