Back in the 1990s and 2000s, Australian perceptions of the bilateral relationship with China were marked by a surprising degree of unanimity. Without implying that the clustering of opinion was confined to Australia’s capital city, let’s call that phenomenon the ‘Canberra consensus’. It was marked by a set of shared judgments; specifically that China’s rise offered a grand set of economic benefits to Australia at relatively low strategic risk. China was thought unlikely to disrupt the peaceful regional order that underpinned its own development. And a richer China would probably also be more politically pluralistic.

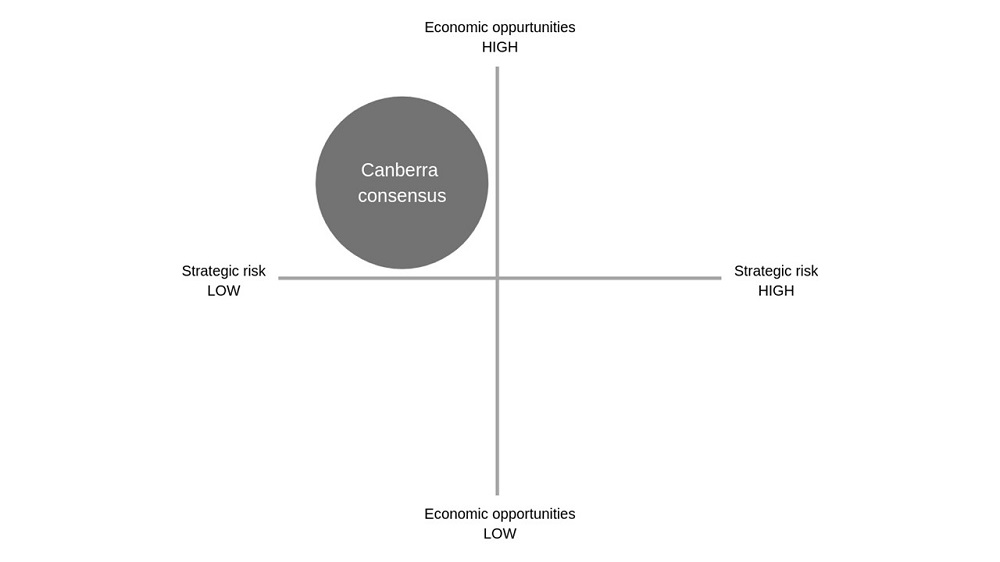

If we were to depict that consensus schematically, with economic opportunities on one axis and strategic risks on the other, it would look something like this:

A quick scan of the alternative quadrants of the schematic highlights the allure of the northwest one. It allows the bilateral relationship to live in an ideal world of high returns and low costs. And that’s been the core of the Australian relationship with China for much of the past few decades.

But in recent years the Australia–China relationship has taken on a new level of complexity. In particular, it’s been marked by a greater sense of strategic competition. China has become more assertive under President Xi Jinping. Its behaviour in the South China Sea has underlined both its growing military and paramilitary capacity and its willingness to act in defiance of the 2016 ruling of the Permanent Court of Arbitration. Attempts to buy influence among both federal and state politicians have played poorly with Australian audiences. Chinese bids for substantial pieces of Australian infrastructure have raised questions about whether their motives are entirely commercial. And the issue of cyber-espionage and hacking has maintained a steady electronic hiss as the background noise to the broader relationship.

True, the economic relationship hasn’t suffered much. Indeed, in trade terms, it remains strong, with two-way merchandise trade with China constituting 29% of our total merchandise trade. Chinese investment in Australia is down, but that’s in part the result of Canberra’s becoming more protective of its key infrastructure. The number of Chinese students in Australia remains high, even though that’s one area where Beijing could exert easy influence.

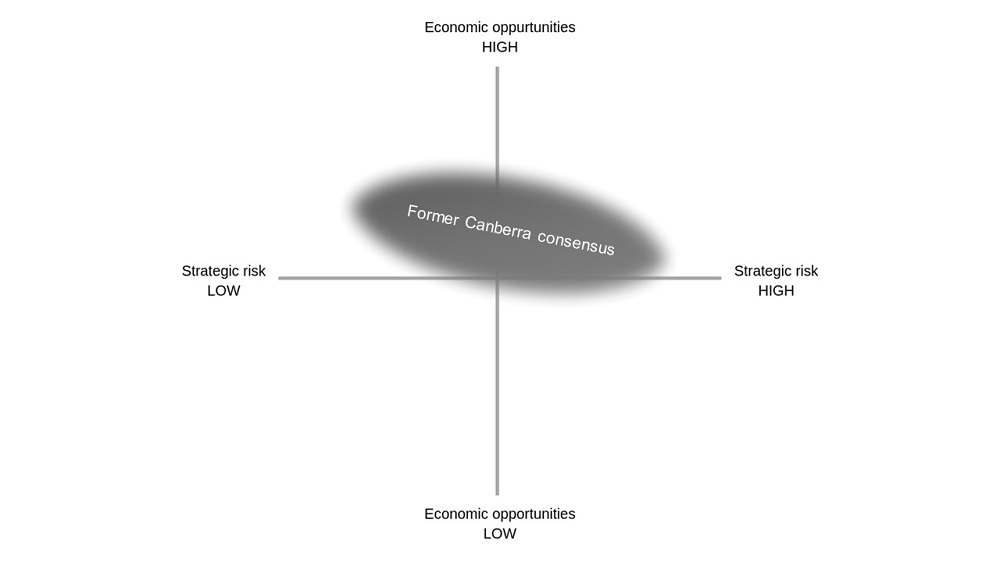

Still, as the strategic risks associated with relationship have become more complex, the traditional Canberra consensus has broken down. Schematically, fast-rising Chinese power has smeared the usual single blob in the northwest quadrant eastward across both northern quadrants. To be precise, the smear has actually been east-south-eastwards, because the sense of economic opportunities has wilted as the sense of strategic risk has grown:

It’s hard to put a specific date to the breakdown of the Canberra consensus. Certainly, when Prime Minister Tony Abbott told German Chancellor Angela Merkel in late 2014 that Australian policy towards China was driven by ‘fear and greed’, the consensus was already struggling—because its dominant fulcrum might better be described as ‘fearless greed’. Perhaps the collapse of the consensus has something to do with the perceived waning of US unipolarity—because that was the strategic environment under which fearless greed flourished.

Still, Australian opinions about the bilateral relationship have become steadily and more sharply divided in the years since. They’ve also become more atomised, sparking a series of debates over whether, and to what extent, China poses a threat to Australian strategic interests. Former prime minister Paul Keating described Australia’s security and intelligence mandarins as ‘nutters’. Former trade minister Andrew Robb criticised the Coalition’s new leaders for souring the bilateral relationship. More modestly, Peter Drysdale has urged both countries to sit down and identify their shared strategic interests—helpful, perhaps, but not in itself a recipe for the successful resolution of different strategic interests.

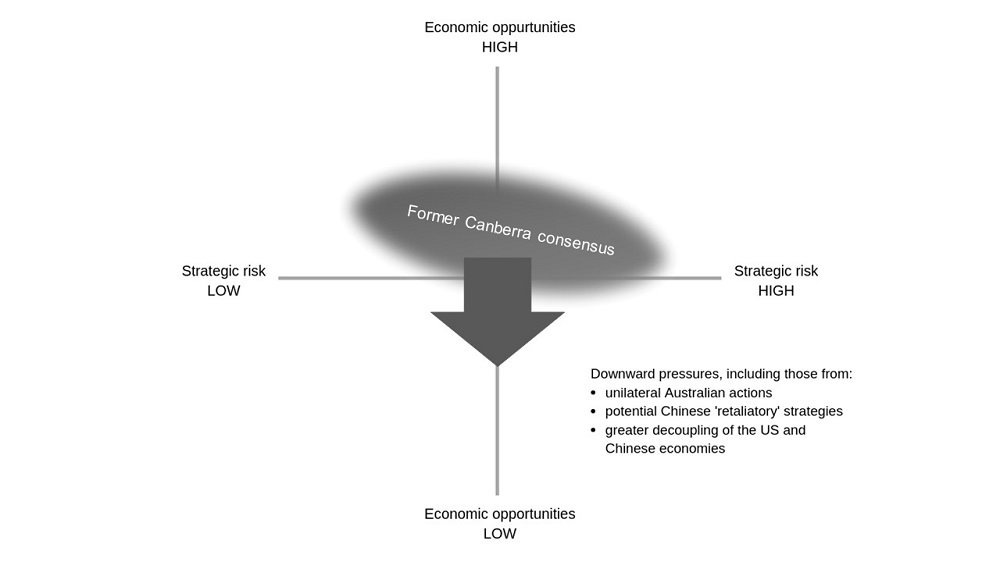

The broader Australian debate is now also marked by a sense of likely further downward pressure on the bilateral economic relationship. That pressure emanates from three different sources:

- Australian action, similar to that already taken in relation to Huawei and 5G, which circumscribes particular areas of emerging trade or investment, or, more broadly, promotes active diversification of Australia’s trade and investment portfolio

- possible attempts by China to coerce Australia economically as leverage for a different set of policy outcomes

- and the growing trade war and broader ‘decoupling’ of the US and Chinese economies that’s already under way.

If we add those pressures to the schematic, it looks like this:

In short, we might soon have a debate spread across all four quadrants. The northwest quadrant remains attractive—but there’s no way to get back there. The Canberra consensus is gone.