Australian companies are getting the point—trade with China is hostage to the actions of the ruling Chinese Communist Party regardless of consumer desires or business partnerships formed over decades. We now need to move beyond handwringing and think clearly about where our trade with China is structurally secure and where it’s subject to the whims of the CCP. The good news is that the maturing Australian debate now has room for this approach.

Following barley, now Australian wine is subject to a Chinese anti-dumping investigation. As usual, Chinese officials are denying that this is because of Australian decisions that are against the CCP’s wishes, but it’s impossible to believe that the actual motive is addressing aggrieved Chinese wine producers facing cheap competition from Australian producers. It’s even harder when you consider that luxury wines like Penfold’s Grange also seem caught up in the investigation.

China’s ambassador to Australia, Cheng Jingye, foreshadowed this back in April when he said, ‘Maybe also the ordinary people will say why should we drink Australian wine or to eat Australian beef?’ Of course, it’s not Chinese consumers clamouring to stop our wine exports. But the ambassador did us a favour by letting Australians know the nature of the regime that is the gatekeeper to China’s economy.

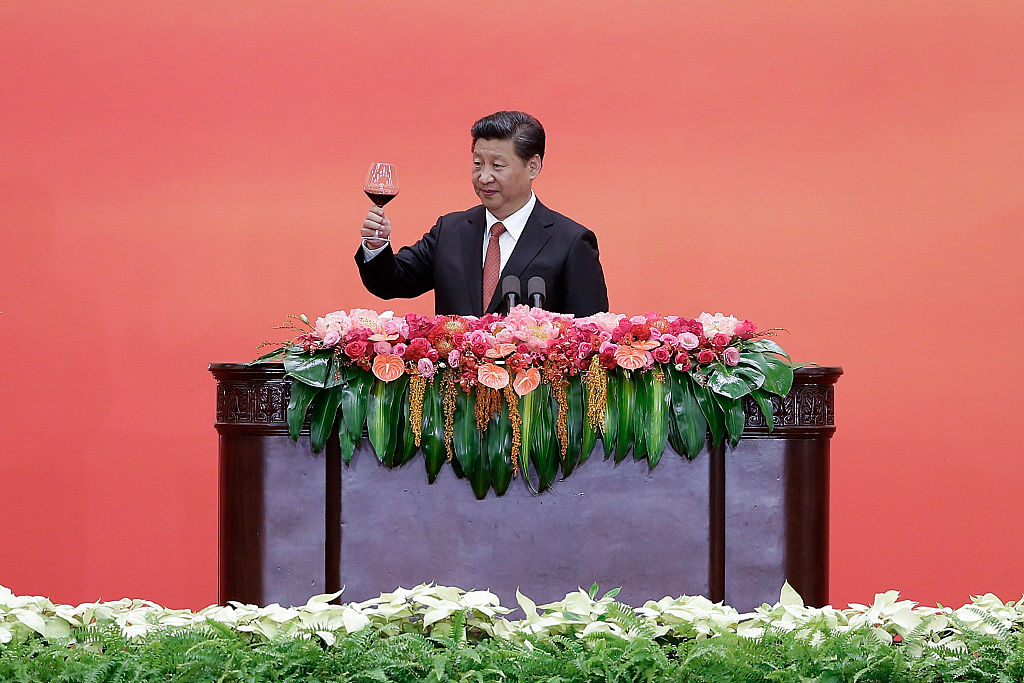

Put bluntly, the Chinese government under Xi Jinping is a coercive outfit that has no qualms about using economic measures and technicalities as tools to punish and pressure those who act against its interests. And Australians will keep doing things that are against the Chinese government’s interests as long as we believe in values and freedoms that Beijing simply does not. Except for chunks of the business and academic community who still harbour ideas that it’s all about the tone of our engagement, Australians already know the problem is one of substance, not tenor. That’s why public trust in China to act responsibly in the world has collapsed from 52% to 23% in just two years.

Our systems of governing and living are too different for this to be otherwise. Hong Kong shows this very practically: could any Australian government stay silent and do nothing while we watch the violent and repressive acts of the new national security apparatus Beijing has imposed on 7.5 million Hongkongers, particularly given our own Hong Kong diaspora and the 100,000 Australian expats living there? If freedom of speech and the rule of law matter, not rule by the whim of those in power, then we will continue to need to protect and advance these values domestically and internationally.

We will also need to continue to deter further aggressive expansion of China’s military reach and presence, whether it’s in the South Pacific, the South China Sea or Southeast Asia. These things are about us and like-minded countries wanting a free and open region and world in which to live.

The areas where we trade and engage more deeply with the Chinese economy must be carefully calibrated as a result. Structural needs, not discretionary ones, are the areas where Australian trade can be more secure from Beijing’s economic hostage-taking. And those structural needs will change over time.

Right now and likely for at least the next decade, the Chinese economy needs the huge volumes of iron ore and energy that Australia supplies, and economies of scale and efficiency mean that we are simply the best-placed supplier.

That’s why BHP, Rio Tinto and Andrew Forrest’s Fortescue Metals Group have not been on the receiving end of punishment from Chinese officials. It was touching to see the rapport with the Chinese consul-general in Melbourne, but neither Forrest nor any of the shareholders in his company should believe that it’s their close friendships with Chinese officials that have made them successful.

As we heard from Taylors Wines, 30 years of partnerships with Chinese colleagues has not helped them avoid being the latest victims of Beijing’s way of operating. When the party calls, the Chinese apparatus answers and friends are left wondering what happened. Protection only comes where Australia has a clear comparative advantage in what we sell and where the Chinese economy has a compelling need that party officials recognise.

This way of assessing the risk in engaging with the Chinese economy is well within the grasp of our government and businesses. It requires an in-depth understanding of the health, directions and needs of the Chinese economy, including how the planned transition from a production- and export-based economy to a consumption- and services-based one is, or is not, occurring. It also requires us to understand Xi’s strategic drive to make the Chinese economy less dependent on others, while ensuring other economies become more dependent on China’s. That’s something we can—and should—avoid through policy, forethought and planning.

An objective assessment of the changing Chinese economy’s needs will include the fact that at some point Chinese demand for iron ore will begin to fall, simply because infrastructure-creation has occurred and the planned shift away from an economy centred on heavy industrial production has made some progress. What’s a structural need now will not be so in coming years. Right now, Chinese policymakers have slowed this shift because stimulus measures that pump-prime this ‘old economy’ are the levers close to hand in the middle of the Covid-19 pandemic. Revenue is flowing to Australia as a result.

While ‘at least a decade’ sounds reassuring, it’s not. The timescale means planning is necessary now, as our big energy and resource companies have long lead times to change their operations and markets.

Despite much of the public debate and the massive disruption the pandemic has caused, higher education—another area where China’s ambassador has threatened a consumer boycott—probably also has at least some structural security in engaging with China.

That’s because Australian universities have the capability to produce high-quality skilled workers and do world-leading research. The Chinese economy can’t get enough of either and that need is likely to endure. Of course, there are strings attached when that research is turned to the advantage of China’s military or internal security apparatus, and when fear of reprisal limits freedom of expression on campus. Again, new business plans are required to assess the structural need and to then plan for how it can be met while protecting the integrity and quality of education and research in our universities.

In most other areas of trade, the Chinese government can inflict economic pain on Australian companies and sectors, and those that are overexposed to the Chinese market will feel this the most.

This is an absolutely foreseeable business risk, so it’s one that companies, industries and the government agencies that work with them must understand and factor into their plans. That’s happening with wine even now, and the industry has also sounded a note of confidence about the quality and appeal of the wine we produce. That self-confidence is well placed and not just when it comes to wine.

Just as climate change and cybersecurity risks took a while but have now made their way into the planning frameworks of many Australian and global corporations at board level, this coercive risk from the Chinese state can now become a normalised business planning factor. CEOs and directors who fail to adequately plan for this risk will have audit committees and shareholders wanting to know why duties may not have been adequately discharged. In contrast, those who do take this risk into account will be rewarded by shareholders.

I’m optimistic that Australia has come out of the reflexive crouch that occurred whenever the Chinese government made noises about punishing Australia for doing what we must.

The pandemic is inflicting more pain than any amount of Chinese economic coercion, even in sectors that are at the most risk from Beijing’s actions.

Our public debate is maturing. We have largely stopped acting like victims of violence who blame themselves, not the perpetrator, and we’ve started to make plans that consider both our security and our economy in light of the situation we’re living in. Prime Minister Scott Morrison’s recent speech to the Aspen Security Forum shows that. The maturing understanding in Australia’s business world is moving in the same direction. Further naked coercion from Beijing will only deepen this trend.