For the past 16 years, I’ve had the pleasure and privilege of working at ASPI. But the time has come to say goodbye. To mark my retirement, the editors of The Strategist have invited me …

Australia and New Zealand have a proud history of shared military endeavour. Over more than a century, from the shores of Gallipoli to the sands of Iraq, Australian and New Zealand troops have fought side …

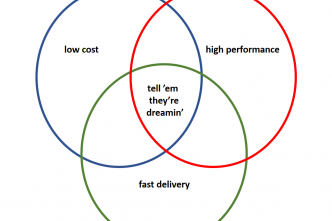

The organisational reforms to defence acquisition that followed the First Principles Review were extensive. Cassandras that we are, at the time we worried about the risk of a ‘perfect storm’ of deteriorating external strategic circumstances, …

The Joint Standing Committee on Foreign Affairs, Defence and Trade is running an inquiry into the desirability of a long-term defence agreement. The idea is that the core components of defence policy (such as the …

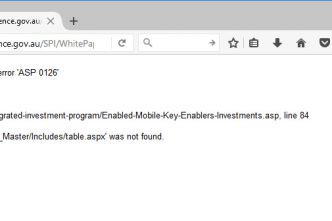

In February 2016, Defence said it would produce a ‘periodically updated’ online version of its Integrated Investment Program (PDF) to ‘ensure industry has access to current information’. More than 16 months later, we can …

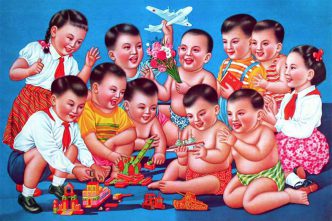

The Chinese Communist Party exercises sovereignty over 1.4 billion people. In doing so, it suppresses free speech, regulates political activity and exercises a pervasive program of propaganda in education, the arts and the news media. …

The 2017 ASPI Cost of Defence will be launched tonight. Here’s the executive summary, and here’s a copy of my remarks at the launch event in Canberra. Regular readers of The Strategist will have seen my analysis of …

A key metric for the delivery of the 2016 Integrated Investment Plan is the approval of defence procurement projects. However, after years of uninterrupted transparency, the government has stopped disclosing what it approves. While that …

Back in March, the Minister for Defence announced the results of a study of JSF-related exports by PwC. She said that the ‘Joint Strike Fighter program will create 2,600 extra defence industry jobs by 2023, …

Last week, I argued that Australia needs stronger defence. Today I suggest how that might be achieved. Current plans strengthen Australia’s defences slowly. For example, the first of our ‘future submarines’ won’t enter service until …

Sometimes events move quickly. In December 1998, John Howard wrote to his Indonesian counterpart B.J. Habibie, suggesting that East Timor should vote on self-determination. Fewer than ten months later, Australia was leading a UN sanctioned …

The Coalition went to the 2013 election with the promise of ‘no further cuts to Defence spending under a Coalition government’. That lasted until the 2014 Budget, when Defence was hit with a 0.25% increase …